Reverse Mortgage Newport Beach

Our mission is to provide the best support for those interested in acquiring or learning about reverse mortgages and looking for the best reverse mortgage Newport Beach has to offer. Whether you are new to the world of reverse mortgages in Newport Beach or looking to refinance an existing loan, we are here to help. We are a family operated California mortgage lender local to the Orange County area. We are committed to making sure our service stands out with our personalized attention and our ability to offer the lowest rates the industry has to offer.

REVERSE MORTGAGE COMPANY IN NEWPORT BEACH CA

Why Choose Our Company as Your Newport Beach Lender?

At Green Monarch, a reverse mortgage company in Newport Beach CA, we pride ourselves in taking the time to learn about our customers’ individual needs and informing homeowners of all of their options so that they can make the best possible financial decisions for their family’s future. Unlike big banks and branches we do not hit our clients with a ton of fees to cover overhead costs. This is because we are a tight nit, family owned business which also allows us to provide personalized service to each customer’s individual needs.

If you would like to learn more about reverse mortgages and to find out if you qualify or looking to refinance a current loan to get a better rate call us at 800-345-2041 to speak to one of our friendly loan specialists or schedule a complimentary, no obligation consultation through this link.

Plan Retirement Through Equity

Going From a Good to Great Retirement could be just a single click from it!

Currently, many senior homeowners are figuring out new ways to convert their biggest assets into a stream of income. Most Americans want to live in their homes forever and never run out of cash. We can make this a reality!

Let Green Monarch show you how to win the four L’s of financial freedom….

1. Lifestyle 2. Legacy 3. Liquidity 4. Longevity

Utilizing home equity correctly can not only lower financial worry but open up a world of possibilities to live a fun, joyful life. A reverse mortgage could be your solution for a comfortable future!

Compare your Options & Find the Best Solution for You!

NEWPORT BEACH REVERSE MORTGAGE IS

A Newport Beach reverse mortgage is a home equity loan that gives homeowners, 62 year of age and over, the opportunity to borrow money using their home's equity as security for the loan. A reverse mortgage is a monetary solution for seniors looking for a way to create financial independence in retirement.

Steps in Getting A Reverse Mortgage

1. Learn & Educate

Speak with a Green Monarch, a reverse mortgage lender in Newport Beach CA, to discover if a reverse mortgage is right for you and to discuss your specific needs. We will go over your options, the benefits of a RM, and any related costs.

2. HUD Counseling

Government requires all Reverse Mortgage applicants to complete HUD approved counseling. This session is quick (30 minutes) and performed by an unbiased third-party agency.

3. Reverse Mortgage Application

After you are finished with the HUD counseling, we will set up a meeting to go over your reverse mortgage application and provide you with some of the required documents.

4. Receive Your Money

The completion of the Reverse Mortgage is when you will receive your money. Your payments will be made in the fashion you have chosen.

Frequently Asked Questions

-

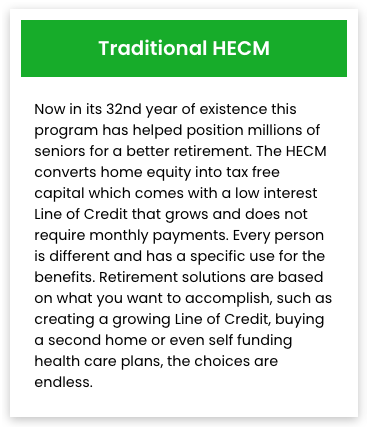

What types of reverse mortgages are available in Newport Beach California?

Many people know about the 3 main types of reverse morgages, but in fact, there more than 3 types of reverse mortgages in Newport Beach California! In California there are actually over 50 types of Reverse Mortgages avaiable. This is why it is important for homeowners to not rely on online calculators alone.

Each individual has unique options and homeowners benefit from talking to a specialist before making any decisions as to whether or not a reverse mortgage is the right path for you to take. This is because there are usually many options to cover and consider.

-

Are there specific requirements to get approved for a reverse mortgage?

In most cases it is not difficult to qualify for a reverse mortgage loan. Generally, the specific requirements are to have roughly 50% equity in your home, be 55 years of age and proof of any income such as Social Security.

-

How long does it take to get approved for a reverse mortgage?

Approvals are quick and most loans will close within 30-45 days.

-

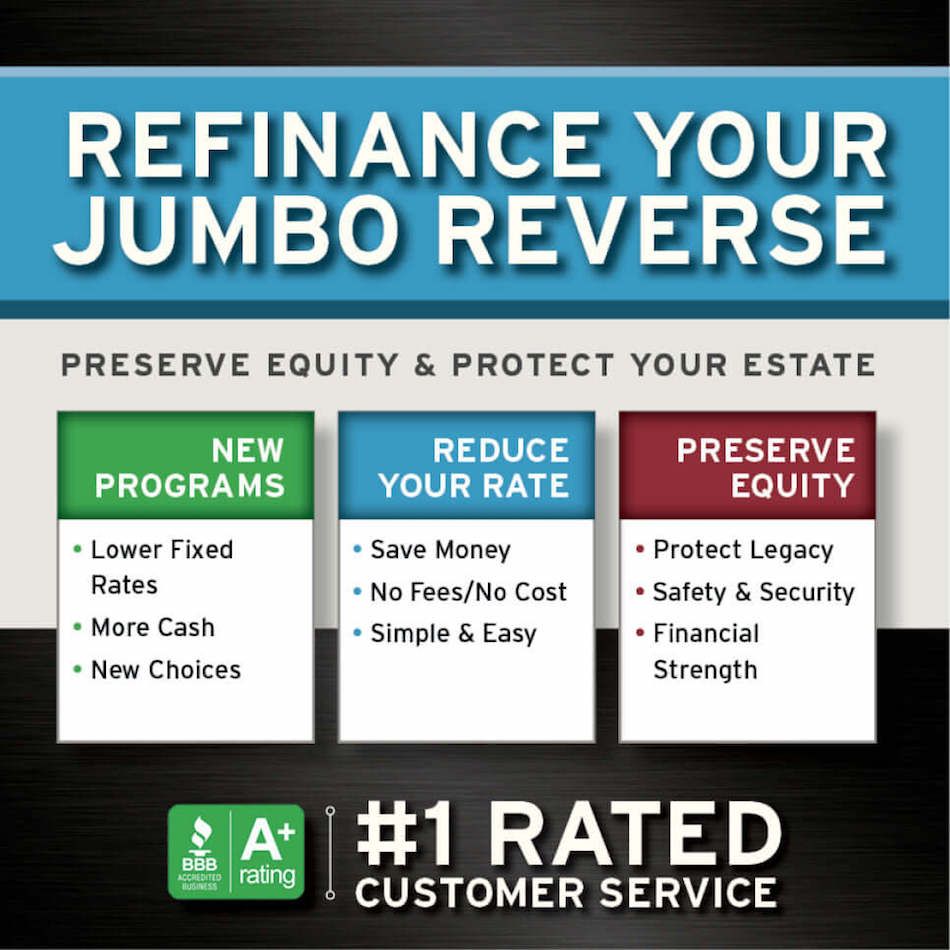

Is reverse mortgage refinancing in Newport Beach possible?

Yes, you can most definitely do a reverse mortgage refinance in Newport Beach. Most of our clients, at some point, refinance reverse mortgages in Newport Beach to lower their rates, take advantage of new programs or recieve more money!

-

Can you sell your house if you have a reverse mortgage?

Yes! Keep in mind... a Reverse Mortgage is a mortgage! There are no limitations and no pre-payment penalties. You can sell your reverse mortgage at any time if you so choose.

-

Who is the best jumbo reverse mortgage lender for refinancing in Newport Beach?

The best lender in Newport Beach to refinance your reverse jumbo loan is one that has access to all of the California reverse mortgage programs. The jumbo reverse mortgage refinance company in Newport Beach should also have the ability to match the lowest current interest rates available.

CALCULATE REVERSE MORTGAGES IN NEWPORT BEACH

If you're a senior homeowner in Newport Beach looking for an additional stream of income to help with expenses or to make a large purchase, you may try to calculate reverse mortgages in Newport Beach to see what your options are. With the help of a reverse mortgage specialist you might be surprised how much your home equity may come in handy to help acquire financially freedom in retirement!

Could a Reverse Mortgage be the Solution For You?

People are living longer lives than ever before. Because of this, people are enjoying their retirement for decades. Unfortunately social security and pensions are not typically enough to provide adequate income to comfortably afford, let alone enjoy, retirement. This is where a reverse mortgage can help!

With things like food, electricity and health care costs on the rise, it is becoming more common for homeowners to consider using the equity in their homes to bring in an additional stream of income. Not only can a reverse mortgage help ease financial worries but these types of loans also allow homeowners to stay living in their homes forever.

Reverse Mortgage Calculator for Newport Beach

Have you heard of or ever tried using a

reverse mortgage calculator for Newport Beach? How did it work out for you? You may not even know the answer to that because you may not know what to compare it with to know if the the

Newport Beach reverse mortgage calculator worked well or not. At Green Monarch Mortgage, we believe that the only way to find the right reverse mortgage loan for each of our clients is to speak with them and have a very personalized talk to start.

Most homeowners are not aware, there are over 50 California reverse mortgage options. Everyone has there own unique set of circumstances which tell their own story for their wants and needs financially for retirement. While one reverse mortgage loan program may be the right fit and work for one family, it may not work the same way for what the next family needs or wants. So, if you figure in 50 reverse mortgage options, along with everyone's different living situations, you can see why relying on a reverse mortgage calculator to find the best loan for your specific needs, would not work nearly as well as speaking to a professional expert in reverse mortgage loans and having them help find the best loan out of the 50 plus options available for you.

We decided to completely pull the reverse mortgage calculator for Newport Beach CA off of our website because of how much more success we had as consultants, finding the best loan solutions for our clients, when we talked to them first. You can read all about Green Monarch taking the California homeowner reverse mortgage calculator down from the site through the link below.

How the California Reverse Mortgage Calculator Works

Reverse Mortgage Refinancing Lenders in Newport Beach

If you search online for

reverse mortgage refinancing lenders in Newport Beach to see if you can refinance your loan, the answer is yes. If you have a jumbo loan, you can

refinance jumbo reverse mortgages in Newport Beach and anywhere in California as well. You also do not have to use the same lender to refinance your loan. This is important because a lot people who have a reverse mortgage either do not know they can refinance with another lender or feel some sort of obligation to do it with the same lender.

The biggest obligation you have is to do what is best for you and your family. Green Monarch Mortgage has access to every California reverse mortgage program and loan options available, which there are over 50 of them. Some lenders only offer the programs their company is promoting due to incentives and agreements, which can trickle down throughout their branch offices. The bigger mortgage companies carry more overhead which may result in more hidden fees or backend interest rate increases to cover their expenses.

Green Monarch is not just a branch of another lender and we are a smaller, boutique, family run Mortgage lender. Bottom line, we have access to all of the reverse mortgages in California and since we do not carry the overhead like the bigger lenders, so we can provide the lowest rates of any reverse mortgage refinancing lenders in Newport Beach as well. So, if we give the best custom support too, why would you go anywhere else for one of the most important financial decisions of your life?

If you would at least like to see for yourself how friendly and knowledgable we are, please give us a call at

800-345-2041 or feel free to schedule a

reverse mortgage advisory call with us and we would be happy to provide any assistance we can at your convenience.

Newport Beach, CA

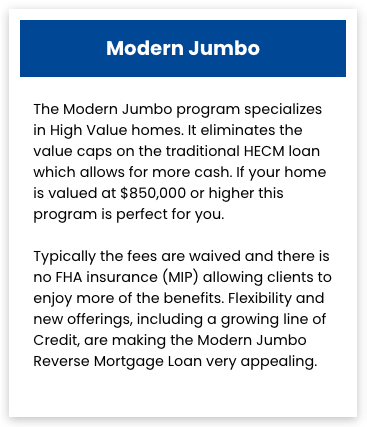

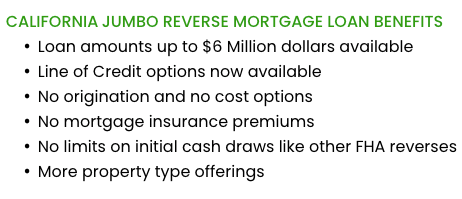

Jumbo Reverse Mortgage Lender Newport Beach Ca

The best way to find the lowest rates on a jumbo loan in California is to work with an expert

jumbo reverse mortgage lender in Newport Beach CA, that has a great reputation for having top-notch, personalizes customer support and ability to offer the best rates available in the lending industry. The more willing a lender is to spend time getting to know you and your exact needs, the better chance you will have at receiving the best options on a

jumbo reverse mortgage in Newport Beach California.

There are not requirements to make monthly mortgage payments With jumbo reverse mortgage loans. you are not required to make monthly payments and any cash you get from it is always tax-free. Give yourself better financial health from your housing wealth.

Refinance Jumbo Reverse Mortgage Newport Beach

You can refinance your Newport Beach jumbo reverse mortgage with any California mortgage company. We can provide the lowest rates in the industry and we have access to all of the jumbo reverse mortgage programs, so why not try us? Not to mention, we know that no other lender will work harder and provide a higher level of customer support than Green Monarch. Give us a chance, you got nothing to lose! Give us a call to at least say hello and you will see how friendly and knowledgeable we are. This is all we ask. We promise, you will not be disappointed!

Solutions that work, with a team that cares!

Green Monarch Inc.

1389 Calle Avanzado, San Clemente, CA 92673

Reverse Home Mortgage

All Rights Reserved | Green Monarch Inc.

California Department of Real Estate, Real Estate Broker #02126127 – NMLS# 2026203

Web Design and Marketing By VeerMobile.com