Reverse Mortgage Newport Beach

Get Your Reverse Mortgage in Newport Beach With A Team That Cares...

Make Retirement A Whole Lot Easier!

Start Enjoying Your Retirement!

We can help you stay in your Newport Beach home forever and not run out of cash!

- Access Expanded Financial Resources!

- Improve Your Home with Renovations and Enhancements!

- Create a Safety Net for Unforeseen Circumstances!

- Enjoy Tranquility and Security!

- Protect Your Family!

How A Reverse Home Mortgage May Help

Imagine this: you miss your Newport Beach mortgage payment and instantly unlock a flow of cash!

Receive Tax-Free Cash

Create a Line of Credit for Life's Unexpected Events.

Establish a Steady Source of Income.

Green Monarch is dedicated to providing exceptional, personalized guidance on reverse mortgages in Newport Beach. As a local, boutique-style, family-owned lender, our clients' satisfaction is our highest priority! We empower them with the essential information needed to make savvy financial choices for their families.

REVERSE MORTGAGE LENDER NEWPORT BEACH CA

Why Choose Us In

Newport Beach?

At Green Monarch, we take immense pride in serving as a premier reverse mortgage lender in Newport Beach, CA, offering customer support that stands out as unparalleled in the industry. Our locally operated reverse mortgage company in San Clemente, CA, is a close-knit, family-run business. In contrast to larger banks and institutions, our modest size enables us to maintain lower fees, allowing us to provide outstanding loan rates complemented by tailored, one-on-one assistance. This ensures that you feel empowered in making the best financial decisions for your family.

Whether you're exploring reverse mortgages for the first time or looking to refinance an existing loan for more favorable terms, if you wish to collaborate with a Newport Beach reverse mortgage company that will handle you and your loan with the respect, care, and support you deserve, just give us a call at 800-345-2041 or click this link to arrange a complimentary consultation.

Retirement Equity Planning

In retirement, the distinction between good and great is merely a click away!

The current economic environment is encouraging many homeowners to reassess their retirement plans. The time when people could rely exclusively on social security and pensions is passing. Thankfully, there are avenues to convert home equity into an additional income stream, allowing homeowners to stay in their homes as long as they desire.

Allow one of our loan specialists to reveal the keys to mastering the four L’s of financial freedom:

- Lifestyle

- Legacy

- Liquidity

- Longevity

By strategically leveraging the equity in your home, you can create a pathway to a joyful and fulfilling life with diminished financial burdens. Contact us today to learn how a Reverse Mortgage could be the ideal solution for shaping a brighter future!

A NEWPORT BEACH REVERSE MORTGAGE IS...

A reverse mortgage in Newport Beach is a financing solution that allows homeowners aged 55 and above to tap into funds by using their home as collateral. This mortgage type acts as a beneficial financial instrument, offering enhanced flexibility to retirement plans.

Frequently Asked Questions

How The Process Works

1. Education

Talk to one of our Green Monarch reverse mortgage lenders in Newport Beach CA, to learn if a Reverse Mortgage is right for you.

2. HUD Counseling

The Government requires everyone who applies for a Reverse Mortgage to do a quick, 30 minute, HUD approved counseling session, performed by an unbiased third-party agency.

3. Application Process

Once counseling is completed we will set up a time to meet so we can go over your loan application and provide you with some of the required documents.

4. Receive Funding

Once everything is complete you will receive your money in the payment form you have chosen.

How a Reverse Mortgage IN Newport BEACH can work for you!

Grasping Reverse Mortgages in Newport Beach

The best way to grasp reverse mortgages in Newport Beach is to develop a thorough understanding of their advantages, going well beyond just the financial figures. Nowadays, people are living longer and savoring many years of enriching retirement. Since a significant portion of an individual's net worth is frequently invested in home equity, more homeowners are exploring reverse mortgages to enhance their cash flow, allowing them to wholeheartedly enjoy their retirement years.

Crafting a strategic plan for the upcoming years can not only assist in managing expenses like healthcare, home improvements, or helping family members, but it can also create opportunities for leisure and enjoyment, travel, or even that coveted luxury item you've always aspired to own! Explore the potential benefits a Reverse Mortgage can provide you today!

Reverse mortgage Calculator in Newport Beach

The promotion of

reverse mortgage calculators in Newport Beach, Orange County, and across California has become exceedingly common in the lending industry. Essentially, you are only sharing your personal information, which then ends up on a marketing list, leading to a barrage of emails, text messages, and an overwhelming amount of flyers and brochures concerning reverse mortgage loans and providers in Newport Beach. When it comes to reverse mortgage calculators, we believe they often do more harm than good.

Refinancing Your Reverse Mortgage IN NEWPORT Beach

Discover the potential of refinancing your reverse mortgage in Newport Beach with Green Monarch.

As an independent lender, free from the constraints of banks or large mortgage corporations with exorbitant overhead, we are able to offer the most competitive reverse mortgage rates in Newport Beach.

One of the key advantages we provide as a reverse mortgage lender in Orange County is our access to a wide variety of reverse mortgage programs throughout California, featuring over 50 distinct loan options.

Many lenders limit their offerings to the programs dictated by their corporate offices, often overlooking other viable solutions. What if a much better reverse mortgage loan is available that you're unaware of due to your lender's restricted product range? Think about the significant savings you could be missing out on.

So, what are the costs associated with refinancing a reverse mortgage in Newport Beach, California?

In most instances, we can structure the new loan to ensure that there are no hidden fees when refinancing your reverse mortgage with Green Monarch in Newport Beach. We also specialize in refinancing jumbo reverse mortgages in Newport Beach, CA.

If you’re eager to learn more about the top programs and most favorable rates available for refinancing reverse mortgages in Newport Beach, feel free to reach out to us at 800-345-2041—we're here to help!

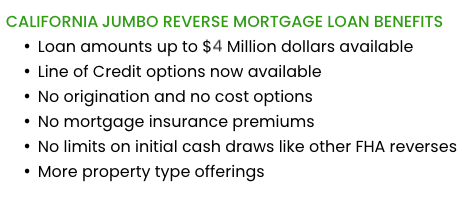

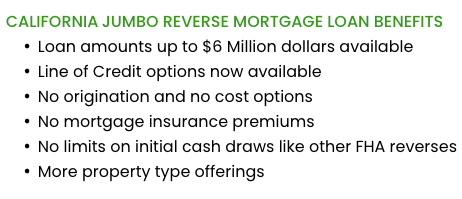

REFINANCE YOUR JUMBO REVERSE MORTGAGE IN NEWPORT BEACH

If you're seeking a highly-rated lender to

refinance your jumbo reverse mortgage in Newport Beach, CA, your search ends with Green Monarch. We are a fully licensed and qualified lender specializing in California jumbo reverse mortgages.

With jumbo reverse mortgage loans, you are not required to make monthly mortgage payments. All cash received is completely tax-free. Let your housing equity enhance your financial health.

Jumbo Reverse Home Mortgage Refinancing

You have the option to refinance Jumbo Reverse Home Mortgages in Newport Beach with any mortgage company across California, but why not choose us? We provide access to all California jumbo reverse mortgage loan programs, offer the most competitive rates, and will handle your jumbo reverse mortgage refinance with exceptional attention to detail.

We are certain that you won't find another jumbo reverse mortgage lending company in Newport Beach that is as dedicated, goes above and beyond, or truly cares about customizing the ideal jumbo loan program to suit your requirements. We aim to be the professionals you seek to help ensure a financially secure retirement for both you and your family. Contact us; we would be delighted to speak with you.

#1 RATED

CUSTOMER SERVICE