Reverse Mortgage Huntington Beach

Green Monarch Mortgage is dedicated to providing personalized service when inquiring about a reverse mortgage in Huntington Beach. We are a local, Orange County company that is family owned and operated. We are a smaller Huntington Beach reverse mortgage lender who puts our client's best interest at heart always and our #1 focus is to provide our clients with all of the information they need to feel confident in making the best financial decisions for their future.

REVERSE MORTGAGE LENDER HUNTINGTON BEACH CA

Why Choose us as your Huntington Beach Lender?

At Green Monarch, as a reverse mortgage lender in Huntington Beach CA, we are most proud of our level of customer support. Our personalized service is unmatched in the industry. Our tight-knit, family operated reverse mortgage company can provide loans with the best rates available due to the fact that we don't have the overhead of big branches and banks. Therefore, we have no need to nickel and dime customers with fees like some of the other lenders do, which will save you money! We offer personalized one-on-one assistance to go over details, answer any questions and break down your options. Our goal is to give you, the customer, the information and guidance you'll need to feel confident in choosing the right financial decisions for you and your family.

Whether you are looking to understand better how reverse mortgages work or you are interested in refinancing a current loan for a better rate, simply give us a call at 800-345-2041 or schedule a free consultation online here. With Green Monarch, you can work with a local reverse mortgage company in Huntington Beach that will handle the process of acquiring your loan with the respect, the care and the support you deserve!

Retirement Equity Planning

A Great Retirement Starts with One Quick Call to Green Monarch Mortgage!

Today's economy is forcing many people to rethink their financial plans for retirement. Gone are the days when seniors could rely on social security and pensions alone. Fortunately, there are other ways to create financial freedom in retirement, such as converting home equity into an additional stream of income.

Our loan specialists would love to show you how to obtain the four L's of financial freedom:

Lifestyle, Legacy, Liquidity & Longevity.

Utilizing home equity the right way can open up a world of opportunities so you can enjoy your retirement fully and live a fun, happy life with less financial worry. A reverse mortgage lets you stay in your home forever while never running out of cash. Learn how a Reverse Mortgage could be the solution you have been looking for to create the retirement you dreamed of!

Compare Your Options & Decide the Best Program for Your Needs!

A HUNTINGTON BEACH REVERSE MORTGAGE IS

A Huntington Beach reverse mortgage is a loan that allows senior citizens, over the age of 62 years old, to take a loan out on using their home as security for the loan. While receiving money, there is no need to pay a mortgage payment. A reverse mortgage is a way to help create a financial flexibility to retirement plans.

How The Process Works

1. Learn Your Options

One of our Green Monarch reverse mortgage lenders in Huntington Beach CA, will help you to better understand how a reverse mortgage works, discuss the pros and cons of a home equity loan, go over with you all of the program options you qualify for and discuss if any of them are the right choice for you.

2. Counseling Session

The law requires everyone who applies for a Reverse Mortgage Loan in California to do a quick, thirty minute, HUD approved reverse mortgage counseling session, performed by an unbiased third party agency.

3. The Application Process

Once you have completed your HUD counseling, we will arrange a meeting in person to go over your loan application together and provide you with some of the required documents you will need.

4. Your Funding

The last step is funding and you will receive your money in the payment form you have chosen. For example: some choose a lump sum while others prefer monthly payments.

Frequently Asked Questions About Reverse Mortgages

-

What are the qualifications for a reverse mortgage in Huntington Beach?

The qualifiactions for a reverse mortgage is no different in Huntington Beach than anywhere else in California. In most cases, reverse mortgage loans are easy to qualify for with approximately 50% home equity, a minimum age of 55 and proof of income such as Social Security.

-

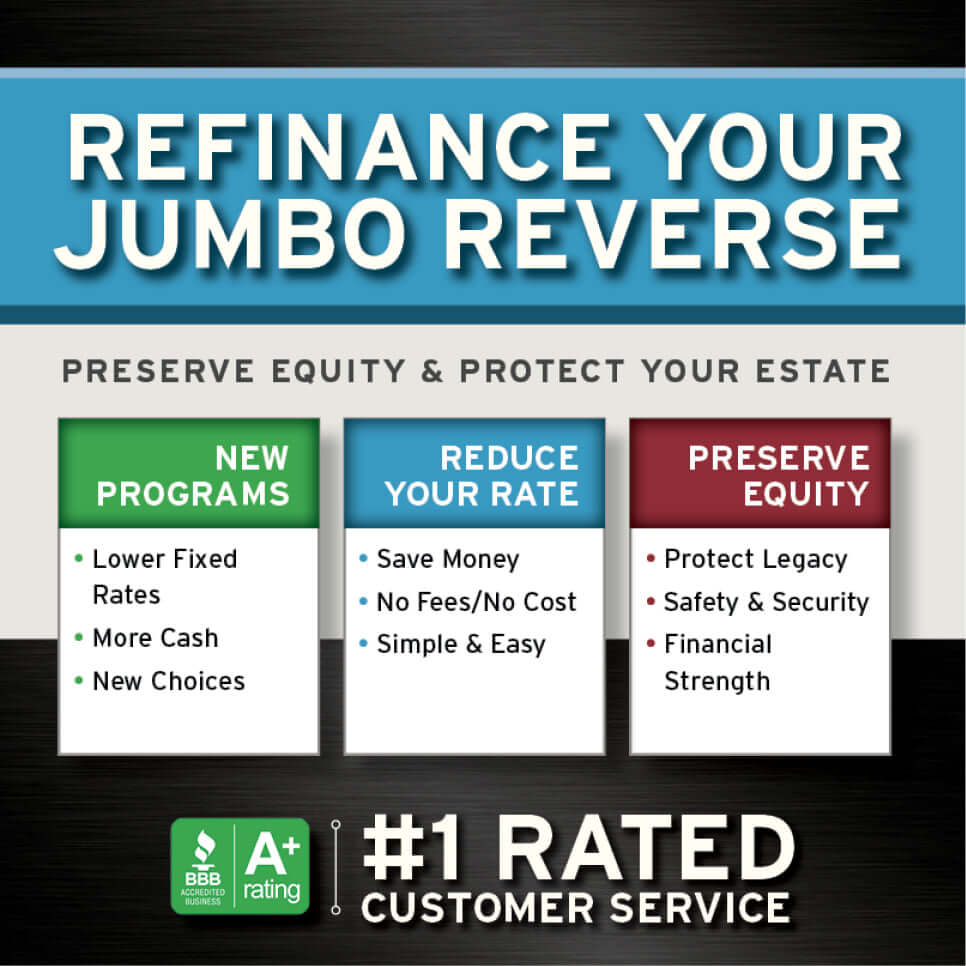

Can I refinance an existing reverse mortgage?

Yes absolutely! In fact most of our clients refinance their reverse mortgages. They do so to take advantage of lower rates, new programs or receive more money. If you would like to refinance a reverse mortgage in Huntington Beach, give us a call today.

-

Can I sell my house if I have a reverse mortgage?

Yes! A Reverse Mortgage is just another form of a mortgage, so there are no limitations and no pre-payment penalties. You can sell your home with a reverse mortgage at any time.

-

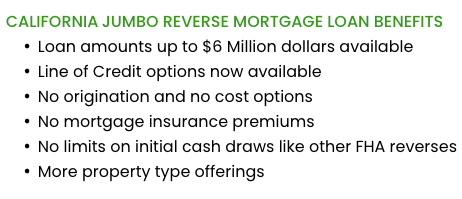

Do you offer jumbo reverse mortgage loans in Huntington Beach?

Yes! In fact we offer the lowest rates on Jumbo Reverse Mortgage Loans in Huntington Beach with zero closing costs.

-

Can a jumbo reverse mortgage loan be refinanced?

Yes! If you are Refinancing a jumbo reverse mortgage in Huntinton Beach, it is no different than refinancing any other conventional reverse home loan. We offer the lowest rates on refinancing jumbo reverse mortgages in California. We can also refinance Jumbo loans that were previously arranged with another lender.

-

Is good credit needed for a reverse mortgage?

Credit will play a role in the financial assessment of a Reverse Mortgage, but typically good credit is not mandatory to do a Reverse Mortgage.

62

Required Age

To be eligible must have a decent amount of equity in your home and be at least 62 years of age.

100%

Tax-Free Payments

Your loan payments are yours to spend on whatever you want. Just be sure to consult with your tax advisor.

Stress Levels

Stay in your home forever! Just pay property taxes & insurance and enjoy your retirement!

0.

Monthly Payments

Instead of paying monthly mortgage payments you will have money getting deposited into your account.

CALCULATE REVERSE MORTGAGES IN HUNTINGTON BEACH

What are the benefits of a Reverse Mortgage?

To calculate reverse mortgages in Huntington Beach it's important to fully understand the different programs available and how a reverse mortgage loan can benefit you. Calculators only give you a rough estimate of numbers and don't even take into consider the many different programs that are available.

Learning the benefits is a great way to determine whether or not a reverse mortgage could help you reach your financial goals in retirement. Developing a strategic plan for years to come is a great way to achieve those goals and pay for important expenses like health care costs, home improvement projects, or helping family. Or perhaps you want money for entertainment purposes, to travel, or make a large purchase. We would love to speak with you to discuss how reverse mortgages work and could be your solution to a great retirement! Explore the possibilities of a Reverse Mortgage today!

Reverse mortgage Calculator in Huntington Beach

You may have tried to research your financial options by using a reverse mortgage calculator in Huntington Beach online with little to no real information that can help you make an informed decision regarding your financial plans for the future. Well you're not alone. Unfortunately most of these online calculators are just tools lenders use to acquire leads and don't offer any real information that genuinely help homeowners seeking information on what their options are. Homeowners then end up on email lists resulting in endless emails, text messages and brochures in their mailbox about reverse mortgages loans in California.

The truth is, there are over 50 different reverse mortgage loan programs in California and a calculator does not even factor this in. Not only can this throw off homeowners trying to assess their options, but these calculators can even discourage homeowners who then may miss out on a great opportunity to enhance their financial situation for the better. This is why we don't use the pointless online calculator.

Everyone has their own unique needs as well. Every loan is not going to be same or provide the right solution for all. The only way to really know if a reverse mortgage would be beneficial to you is to you is to find a reputable reverse mortgage lender in Huntington Beach who can discuss with you what your needs and wants are, have an actual conversation and go over different programs that may work best for you.

If interested, the owner of Green Monarch has a very in depth reason he is sharing about why he pulled the

California reverse mortgage calculator off his website.

Refinance Reverse Mortgage Huntington Beach

Green Monarch Mortgage offers zero closing costs when you refinance a reverse mortgage in Huntington Beach CA.

Since we are not associated with large banks or huge mortgage companies we don't have the bog overhead that a lot of these other lenders have. Because of this we can offer the lowest possible rates available on your reverse mortgage loan whether it's a new loan or a refinanced one. Green Monarch also provides these loans with no out of pocket costs in the process.

A big advantage we have as a reverse mortgage lender in Orange County, which we pass on to our customers, we have access to all of the reverse mortgage programs in California (over 50 different reverse mortgage loan options).

What is the cost to refinance a reverse mortgage in Huntington Beach?

If you are working with Green Monarch, there is zero cost to refinance a reverse mortgage in Huntington Beach with us. We try to make sure there will be no out of pocket cost to our clients and you will definitely not see any hidden fees. You can refinance jumbo reverse mortgages in Huntington Beach with us as well.

BEST JUMBO REVERSE MORTGAGE LOAN REFINANCING COMPANY IN HUNTINGTON BEACH CA

Green Monarch is considered the leading jumbo reverse mortgage loan refinance company in Huntington Beach CA.

We are a fully licensed and qualified

California jumbo reverse mortgage lender.

Make zero monthly mortgage payments with your jumbo reverse mortgage loans. All cash received is 100% tax-free. Housing wealth can help you create financial health.

Refinance Jumbo Reverse Mortgage Huntington Beach

You can refinance your Jumbo reverse Mortgage in Huntington Beach with any lender in California but why not try us? Not only do we have access to every California jumbo reverse mortgage loan program available, but we can offer the lowest rates, give you personalized service, and do you jumbo reverse mortgage refi with zero closing costs.

We also believe that you will not find another jumbo reverse mortgage lending company in Huntington Beach who will care as much about your well being, work harder to put in the effort and take the time to find the best jumbo loan program for you! When making big decisions for your future it's invaluable to have someone in your corner who is not only knowledgable but cares enough to make sure you make the best decision for you and you family in retirement. We at Green Monarch can be that for you!

Solutions that work, with a team that cares!

Green Monarch Inc.

1389 Calle Avanzado, San Clemente, CA 92673

Reverse Home Mortgage

All Rights Reserved | Green Monarch Inc.

California Department of Real Estate, Real Estate Broker #02126127 – NMLS# 2026203

Web Design and Marketing By VeerMobile.com