Reverse Mortgage San Juan Capistrano

Our family operated reverse mortgage company specializes in attentive, personalized service for your reverse mortgage San Juan Capistrano needs! Contact us today for a free, no obligation consultation to learn about Reverse Mortgages, discover all of your options and gain the knowledge to make the best decision for your financial future! At Green Monarch we care about our customers and take pride in the time we spend learning about each of our clients' needs to determine the best possible options.

REVERSE MORTGAGE LENDER SAN JUAN CAPISTRANO CA

What makes Green Monarch the best choice for your Reverse Mortgage?

Our family run reverse mortgage lender in Dana Point CA takes great pride in learning the needs of our customers and providing every possible option available for homeowners looking for a loan. Our mission is to empower you, the homeowner, with the knowledge needed so that you can make the best financial decisions for yourself and your family, in retirement.

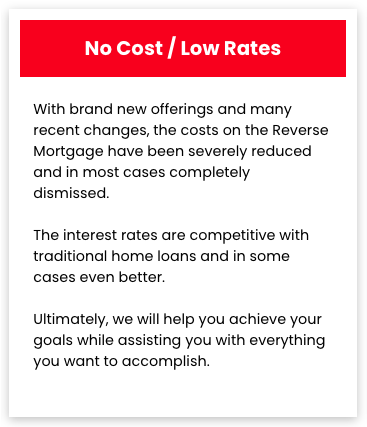

Another benefit to working with us is that we are not a big mega bank or lender with a massive overhead. We don’t need to nickel-and-dime our customers with fees to cover costs like some of these big branch mortgage lenders. Our company, Green Monarch, is tight knit and family operated with many years of experience and very proud to be able to provide our customers with the best rates available all while giving our clients a personal, informative experience from start to finish.

Retirement Equity Planning

One call to us could be the answer to a great retirement!

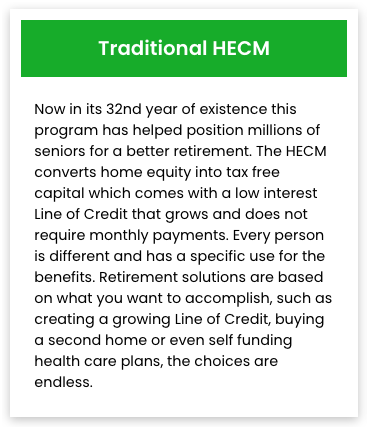

Homeowners these days are often looking for creative ways to acquire financial freedom in their retirement years and often look into ways to convert their financial resources into a new stream of income. People hear about reverse mortgages and sometimes wonder if they will lose their home in the process. This is false. With a reverse mortgage you still own your home, you are just accessing the equity in your home as a way to achieve some financial flexibility in retirement. With a reverse mortgage you can live in your home forever, while never running out of cash.

Green Monarch can help make financial freedom a reality! We would love to show you how to win the four L’s of financial freedom…. Lifestyle, Legacy, Liquidity and Longevity.

Learn about & compare the big differences between all of your options!

A SAN JUAN CAPISTRANO REVERSE MORTGAGE IS

We care about you and want to help you understand exactly what a San Juan Capistrano reverse mortgage is and how it works. With the right lender in your corner you can learn about all your options and decide whether a reverse mortgage is the right financial choice for your retirement! If you are 62 or older you can borrow money using your home as security for the loan. A reverse mortgage adds financial flexibility which can be a great addition to your retirement living.

Reverse Mortgage Lending Steps

1. Knowledge Gives Confidence

As a responsible reverse mortgage lender in San Juan Capistrano, we recommend all of our customers to speak with one of our professional advisors to make sure everyone is on the same page and understanding how everything works.

2. Half Hour Consultation

California requires half hour consultations, by an unbiased third party agency, before approval of a reversal mortgage loan.

3. Application Meeting

After your counseling session is done, we will set up meeting to go over your loan application answer any last questions and provide you all of your required documentations.

4. Get Paid

Upon approval of your reverse mortgage, chose your preferred method to get paid and you will start receiving funds in that manner.

Frequently Asked Reverse Mortgage Questions in San Juan Capistrano

-

What are the pros of getting a San Juan Capistrano reverse mortgage?

Reverse Mortgages can be a good option for anyone looking for more financial flexibility in retirement. So, the biggest pro of a San Juan Capistrano Reverse Mortgage is that it can be a strategic option to fund certain retirement needs and improve your lifestyle.

More San Juan Capistrano Reverse Mortgage Pros:

- Helps secure a more comfortable lifestyle financially during retirement years

- Allows you to stay in your home forever

- Get your existing mortgage paid off

- Payments are Tax Free

- If by chance, your loan balance ever eclipses your home value, you are safeguarded from any issues

-

What are the different types of reverse mortgage programs in CA?

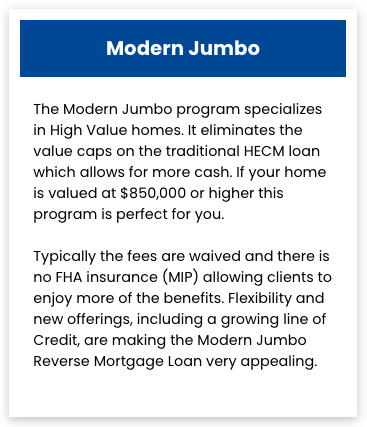

While many individuals only know or think about 3 reverse mortgage types, in actuality there are over 50 reverse mortgage programs here in California. Unfortunately many lenders do not have access to them all and their customers are not made aware of that. Green Monarch have access to every single option for reverse mortgages in California. Give us a call at 800-345-2041 to see if there is a better reverse mortgage for your needs that you may not even know about.

-

What does it take to qualify for a reverse mortgage in San Juan Capistrano CA?

A Reverse Mortgage in San Juan Capistrano is generally easy to qualify for. All you need is for your home equity to be around 50%, a minimum age of 55 and show some kind of income like Social Security.

-

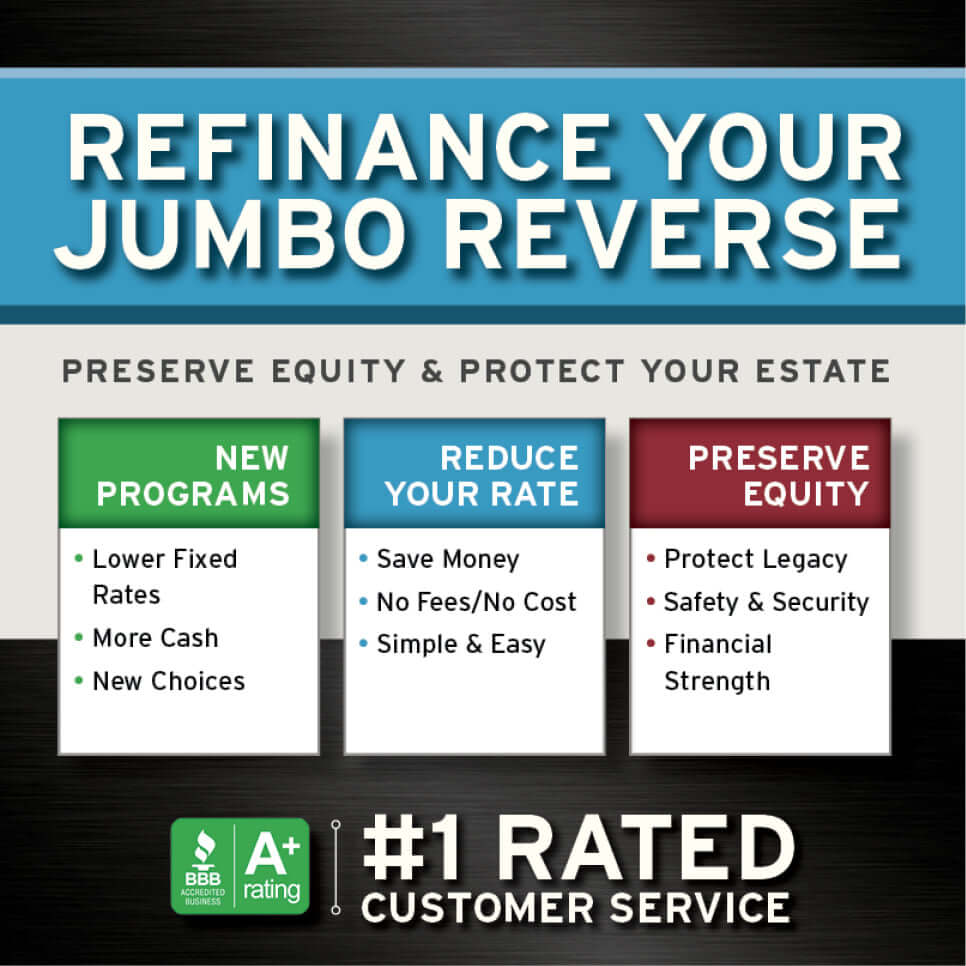

Can my reverse mortgage loan in San Juan Capistrano be refinanced?

Yes, and most of our clients do. So if you are looking to refinance your reverse mortgage loan in San Juan Capistrano to take advantage of lower rates, explore new programs or to recieve larger payments, give us a call.

-

Can I refinance my jumbo reverse mortgage in San Juan Capistrano, CA with a different mortgage company than my current one?

Yes, you can refinance your jumbo reverse mortgage in San Juan Capistrano with a difffernet mortgage lender. You are not locked into having to be with the same reverse lender. Generally, as long as it has been a year, you are free to make any jumbo refinancing decision you want within California reverse mortgage lending guidlines of course.

CALCULATE REVERSE MORTGAGES IN SAN JUAN CAPISTRANO

What are the benefits to getting a Reverse Mortgage?

If you're trying to calculate a reverse mortgage in San Juan Capistrano to determine if a reverse mortgage is your financial solution, you should know that online reverse mortgage calculators are incapable of showing you all your available options and how they can benefit you in your retirement years. We have found that these calculators are mainly just used as a way for lenders to generate leads. If you are interested in finding out what programs you qualify for and want to learn about the benefits of a reverse mortgage it is best to speak with a lender who specializes in reverse mortgages and has access to all 50 of California's reverse mortgage programs.

Reverse mortgage Calculator Dana Point

The truth is that using a reverse mortgage calculator for San Juan Capistrano Orange County and throughout all of California, is not the best way to discover the benefits of a reverse mortgage. In fact using these will usually put your information on a marketing list for phone calls, emails and a mail flyers & brochures. So we don't recommend using them.

We suggest finding an expert lender to discus your options because ultimately there are so many benefits to getting a revers mortgage that most people don't even know about. Plus it's important to keep in mind that everyone has different circumstances and different needs which all come into play when choosing the best reverse mortgage loan program. This is why the calculator does not work and why Green Monarch has decided to take the the reverse mortgage calculator for California off our website.

In order to determine the best San Juan Capistrano reverse mortgage loan option for you, your lender of choice needs to have an actual real, in-depth-conversation with you about your financial situation and your vision for the perfect retirement. This is the only way if a lender really cares about their customers. If you would like to have one of those conversations with us here at Green Monarch Mortgage, you can schedule a free, no-obligation, reverse mortgage personalized consultation. It would be our pleasure to speak with you and assist you with any questions and go over all of your options.

You can schedule a consultation online or can simply give us a call at

800-345-2041.

Schedule a consultation online now.

Refinance A Reverse Mortgage in San Juan Capistrano CA

You can refinance a reverse mortgage in San Juan Capistrano CA with zero closing costs! That's right, with Green Monarch you can refinance with no closing costs. Our family operated reverse mortgage company has no massive overhead like the big banks or branches so we can offer our clients the best reverse mortgage rates in San Juan Capistrano without nickeling & diming customers with added fees.

As a proud, family-run

reverse Mortgage company in Orange County, we can, not only, give the lowest rates but we have access to all 50 of the reverse mortgage programs in California which means more potential options for you! It is important to know that many lending companies only offer the programs that are available under their corporate identity, leaving out programs that may better suit your needs. There could be a much better reverse mortgage option available that no one told you about and that could cost you money!

How much does it cost to refinance a reverse mortgage in San Juan Capistrano?

In most cases, we can structure your loan so there will be no closing costs to refinance your reverse mortgage in San Juan Capistrano California. You can also refinance your San Juan Capistrano Jumbo reverse mortgage.

If you have questions, want to learn more or discover your options on refinancing reverse mortgages in San Juan Capistrano, don't hesitate to give us a call at 800-345-2041 and we will arrange a free consultation with one of our loan specialists.

Jumbo Reverse Mortgage Loan Refinance Lender In San Juan Capistrano CA

Orange County's best

jumbo reverse mortgage lender to refinance your loan in San Juan Capistrano. Green Monarch is a fully licensed and qualified

jumbo reverse mortgage lending company for loans in California.

You are not required to make monthly mortgage payments with a jumbo reverse mortgage loan in Orange County, CA. Money that is received through a reverse mortgage is always tax-free. Learn how your housing wealth can help you create financial flexibility.

Refinance Jumbo Reverse Mortgage San Juan Capistrano

While you can refinance your Jumbo reverse Mortgage in San Juan Capistrano with any lending company, it's important to understand that not all lenders will be able to offer you every program that you qualify for. At Green Monarch we are proud to have access to every California jumbo reverse refinancing program and have the ability to offer the lowest rates, with ZERO closing costs. We work harder than any other lender to get you set up with the best program at the best rates, guaranteed! We are confident you will enjoy working with us so why not give us a call?

Solutions that work, with a team that cares!

Green Monarch Inc.

1389 Calle Avanzado, San Clemente, CA 92673

Reverse Home Mortgage

All Rights Reserved | Green Monarch Inc.

California Department of Real Estate, Real Estate Broker #02126127 – NMLS# 2026203

Web Design and Marketing By VeerMobile.com